Hair salon owners are urgentally calling on the government to reduce VAT and save their industry

and live on Freeview channel 276

Ahead of the government’s Spring Budget, The Salon Employers Association, which represents salon owners from across the country, are campaigning for the government to reduce VAT, which currently stands at 20 per cent, to 10 per cent as they say something urgent needs to be done to save the hair and beauty industry from serious decline.

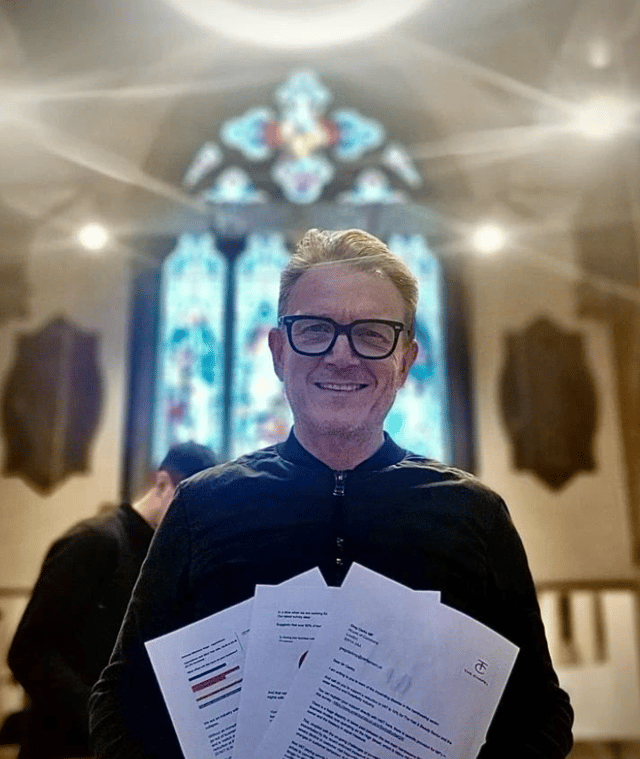

One of the salon owners championing the cause is Lancashire hairdresser Tony Winder, who founded the well known Antony & Patricia salon in Rossendale back in 1969.

Advertisement

Hide AdAdvertisement

Hide AdTony, 76 explained: “The main aim is to level the playing field on our behalf and it's something I've been passionate about ever since VAT was introduced in 1973.

“If we can sort out the VAT, it will sort out a lot of issues in our industry.”

Find out more about why the call is so urgent and what you can do to help now:

Why have The Salon Employers Association launched this VAT campaign?

The association holds surveys for salon owners twice yearly and their latest survey, conducted after the autumn statement “provided some shocking results” according to its founder Toby Dicker, who believes this VAT reduction is “this government's last chance to make a difference to hairdressing salons that we believe are the most taxed on the whole high street.”

Advertisement

Hide AdAdvertisement

Hide AdThe survey found that over 50% of salon owners said that they were considering closing their business right now -a “huge” increase from the middle of last year - and 56% scored in the worst categories for their mental health, answering that they were ‘the most stressed ever and close to breakdown’ or that things are ‘difficult, I’m having lots of sleepless nights’.

Toby says the cause of this pressure can be broken down into three reasons: that consumer behaviour has changed, that the costs of running a salon have gone up, and that salons have to compete with those “who run a disguised employment model and stay below the VAT threshold” by running a 'rent-a-chair' system instead. Each rental chair stylist trades under the £85,000 threshold so they can cut their prices by at least 20% compared to VAT paying salons.

These issues combined create a risk for the future of hair salons as budget squeezed salons are reducing the number of apprenticeships they take on - 96% of salons surveyed said they would not take on any more apprentices and over 40% said they planned to make immediate reductions- whilst non VAT registered salons, like 'rent-a-chair' models, home and mobile hairdressers, do not train apprentices.

51-year-old Toby, who also co-founded The Chapel Group of hair salons 26 years ago, explained: “Government over time has hugely increased the costs that are involved in employing people so employers national insurance has gone up by 37 per cent, VAT has gone up by 33 per cent and what that means is that businesses are now squeezed to literally zero margin.

Advertisement

Hide AdAdvertisement

Hide Ad“Business owners who train the next generation are under an enormous amount of pressure and that's because of the way all of the taxes add up and specifically against certain business models. That means they'll pay 200% more tax than some other business models on the high street and twice as much tax as some other business models within our own industry.”

When asked why their campaign focuses on lowering VAT, Toby replied: “This is a last chance saloon really, we have to call for something and this is the thing that will make the biggest difference right now. We could argue for the next 10 years about different taxes and whether they're fair or not, on apprenticeship costs and training and a multitude of other things. We don't think it's the solution, we think it's an emergency and they need to take this now, like they did in COVID with hospitality - and they left us out at that point.”

Why does Lancashire salon owner Tony support the cause?

Explaining how hard it is to be a salon owner at the moment, Tony said: "My energy cost has gone up three times, you've got stock costs rising, wage costs, insurance costs, and every time you put the key in the door, there's something else going up like the prices for the Performing Rights Licence to play music, that's just gone up! So everything has gone up and obviously, the prices for the client have got to go up and once you put your prices up, you're going to lose some clients because they can't afford it anymore, so what they'll do is look for the alternative and the alternative is to go for a non VAT registered salon because they don't have the cost of employing staff.

"At the end of the day, it’s not the salon owner that's paying the VAT to the government, they're just the collectors so what happens is the clients are paying 20% more to sit in a VAT registered salon chair than what they are to sit in a non VAT registered salon chair, or a home salon or a mobile hairdresser and really, that's not a level playing field because we're now in a period of austerity, and we have been since Covid, so, people are looking for cheaper prices.

Advertisement

Hide AdAdvertisement

Hide Ad"I would say that VAT is the elephant in the room and it's the heart of our industry- if we can sort out the VAT, it will sort out a lot of issues in our industry."

Although Anthony & Patricia is still a successful business, they have had to reduce their apprenticeship numbers from four to two due to the increasing financial pressures and Tony recognises their survival is helped by the fact he bought their premises back in 1973 so has "no landlord around [his] neck."

Tony, who is also a moderator for the organisation 'Salon Owners Unite' says it is more for his fellow stylists and those in the future that the campaign means so much.

He commented: "I've never known it as bad in all my time and I started hairdressing in 1962, so I've gone through lots of hard times- minor strikes, I went through a divorce with a business partner -and it's been very challenging. Obviously, I've been very lucky in some things, and I've survived it, and I will survive it but I'm fighting with Toby and the team for the youngsters who have just opened salons, and they're struggling.”

How much support has the campaign garnered so far?

Advertisement

Hide AdAdvertisement

Hide AdThe campaign has already had public support from a handful of MPs whilst Toby and renowned hair stylist Errol Douglas MBE have lined up future appointments with other politicians, including the Department of Business, to discuss their plight and promote their cause.

Members of the public have also been showing their support by sending video messages about the campaign to their MPS on Twitter/X or writing them letters.

How you can show you support

The Salon Employers Association has prepared a template letter that you can send to your MP, which can be found here.

You can also follow the Salon Employers Association on Instagram to keep up to date with their news and to show your support.

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.