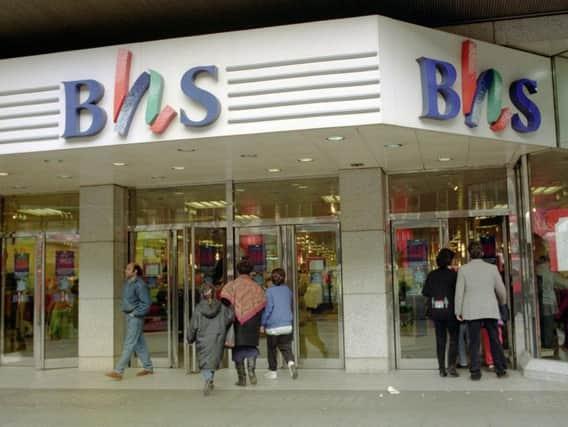

Shutters come down on BHS after no buyer found

The business will be wound down and all BHS's 163 shops will close and be sold off to other retailers. Administrator Duff & Phelps said that 8,000 permanent jobs are likely to be lost and another 3,000 not directly employed by BHS are also at risk.

The news comes after last-ditch rescue bids from former Mothercare boss Greg Tufnell and Mike Ashley's Sports Direct failed.

Advertisement

Hide AdAdvertisement

Hide AdDuff & Phelps said: "Although multiple offers were received, none were able to complete a deal due to the working capital required to secure the future of the company."

The administrator added that BHS will be in "close-down sale mode" over the coming weeks as it proceeds an "orderly wind-down" of the business.

Philip Duffy, managing director of Duff & Phelps, said: "The British high street is changing and, in these turbulent times for retailers, BHS has fallen as another victim of the seismic shifts we are seeing.

"The tireless work and goodwill of the existing management team and employees of BHS with the support of my team were not enough to change the fortunes of the company."

Advertisement

Hide AdAdvertisement

Hide AdUpon hearing the news, one staff member at the Surrey Quays branch in south east London said: "Oh f***."

The worker, who asked to remain anonymous, heard the news from a journalist.

She added: "The managers told us nothing, they're just sitting in the office."

Moments later, customers were asked to leave the store and the shutters closed.

Advertisement

Hide AdAdvertisement

Hide AdBHS fell into administration in April, leaving behind a £571 million pensions black hole and sparking an investigation by MPs into its demise.

Attention will now turn to the role of previous owners, billionaire Sir Philip Green and former bankrupt Dominic Chappell, in the firm's collapse.

MPs are set to quiz both men in the coming weeks.

The pair have been roundly criticised, Sir Philip for paying a £400 million dividend to his family from the business and over his management of the pension scheme, and Mr Chappell for sucking management fees out of BHS before its collapse.